Home Mortgage Tips To Conserve You Cash

Content by-Blalock HooperMortgages are important when it comes to owning or buying your home, but a lot of people aren't sure of what to do and spend too much when they're getting a mortgage. The tips you see here give you information about making your mortgage optimal. Keep reading for more information.

Predatory lenders are still in the marketplace. These lenders usually prey on home buyers with less than perfect credit. They offer low or no down payments; however, the interest rates are extremely high. Additionally, these lenders often refuse to work with the homeowner should problems arise in the future.

Watch out for banks offering a "no cost" mortgage loan. There is really no such thing as "no cost". The closing costs with "no cost" mortgages is rolled into the mortgage loan instead of being due upfront. This means that you will be paying interest on the closing costs.

Before you refinance your mortgage, make sure you've got a good reason to do so. Lenders are scrutinizing applications more closely than ever, and if they don't like the reasons you're looking for more money, they may decline your request. Be sure you can accommodate the terms of the new mortgage, and be sure you look responsible with the motivations for the loan.

Before hop over to here refinance your mortgage, make sure you've got a good reason to do so. Lenders are scrutinizing applications more closely than ever, and if they don't like the reasons you're looking for more money, they may decline your request. Be sure you can accommodate the terms of the new mortgage, and be sure you look responsible with the motivations for the loan.

You may be able to add your homeowners insurance costs to your mortgage payment. One advantage of this is negating the need to make two payments. Instead of paying your mortgage and an insurance bill, you can pay both bills in one payment. If you like to consolidate your bills, this is a good idea.

Know what the going interest rate is. This will help you know when to lock in an interest rate. Many mortgage companies offer to lock you into a particular interest rate for a period of 30 to 60 days. If the interest rates increase, you are protected. If they decline you can opt for the new interest rate.

Save up for the costs of closing. Though you should already be saving for your down payment, you should also save to pay the closing costs. They are the costs associated with the paperwork transactions, and the actual transfer of the home to you. If you do not save, you may find yourself faced with thousands of dollars due.

Pay off or lower the amount owed on your credit cards before applying for a home mortgage. Although your credit card balances do not have to be zero, you should have no more than 50 percent of the available credit charged on each credit card. This shows lenders that you are a wise credit user.

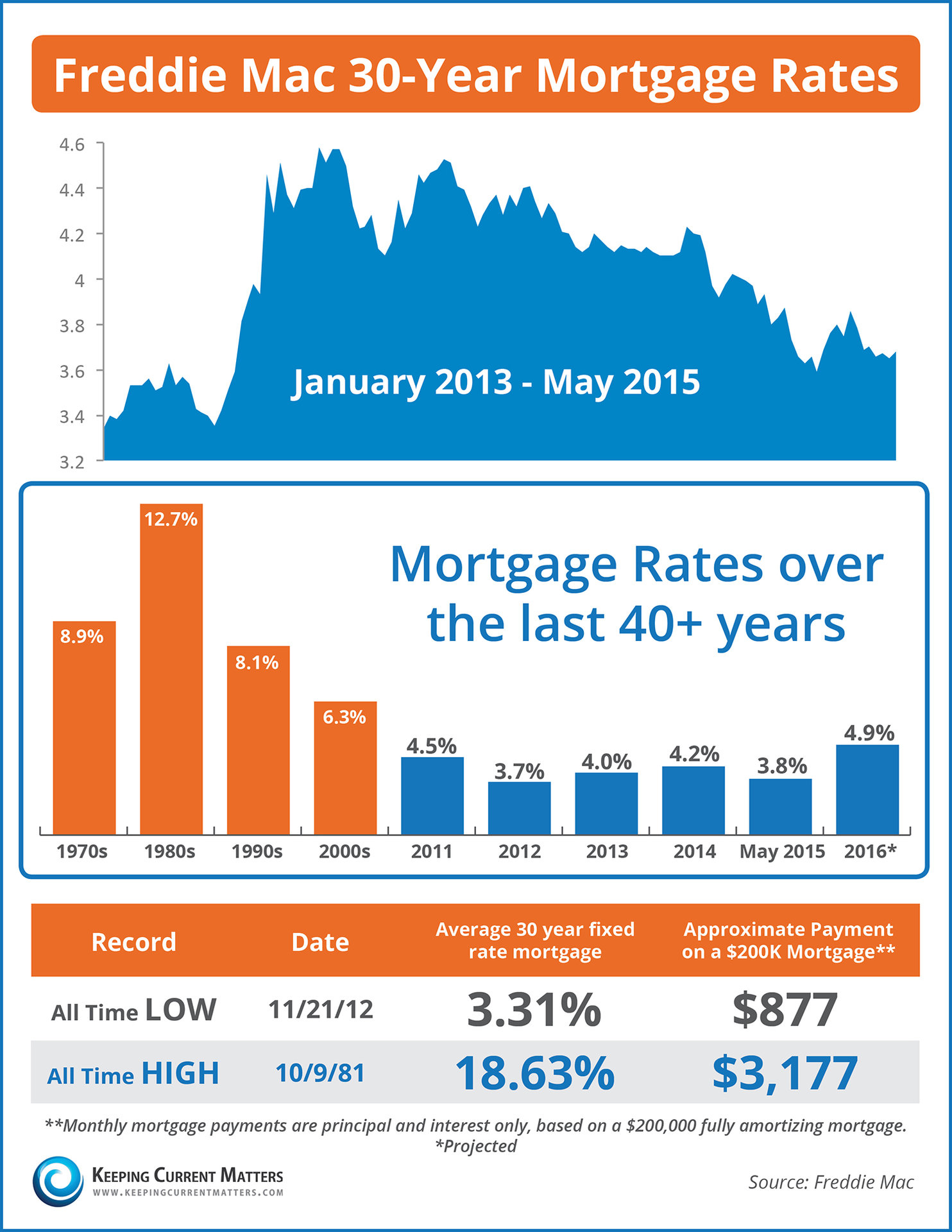

Current interest rates on home mortgages are lower than they have been in years. Experts expect them to begin increasing again shortly, so now is a great time to purchase a home and finance it at a low rate. The shorter the term of the mortgage, the better the rate you will be able to get.

You should have the proper paperwork ready in advance for a lender. Look well prepared. You'll need a copy of your pay stubs going back at least two paychecks, your last year's W-2 forms and a copy of last year's tax return. You'll also need your bank statements. Get those together before the lender asks.

Many people do not have excellent credit. When you are applying for a mortgage is not the time to find out. Check your credit report before applying for a mortgage. Clear up any issues that you may have with the credit agency. This will help you when it comes time to find a mortgage for your home.

If you wish to buy a home in the next year, try establishing a decent relationship with the financial institution. Start by taking out a loan for something small before you apply for a mortgage. https://thefinancialbrand.com/119674/wave-money-app-plunges-hr-block-deeper-into-small-business-banking/ shows your lender that you can meet your obligations.

Be careful about quicksand mortgages. These are mortgages that have all sorts of hidden tricks in them like balloon payments, prepayment penalties, tons of upfront fees, and more. These loans typically are only helpful to the lender, not to the customer. In fact, they can make your loan down right unaffordable over time.

Consider a shorter term of 20 or 15 years for your mortgage if you are able to handle a higher monthly payment. Shorter-term mortgages come with lower interest rates, though they also require higher payments each month. Overall, you will save thousands this way.

If you have a lot of open credit cards, consider paying them off and closing the accounts before applying for a home loan. Many lenders look negatively upon the overuse of credit. So, by closing your credit card accounts, you can show that you are a worthy credit risk for the lender.

You can save money on a mortgage by going with a lender who offers to finance with no closing costs. Closing costs are a significant part of a mortgage. To make up for that lost money, however, the lenders will make up it in some other way. Usually with a slightly higher interest rate.

There are a lot of fees associated with the process of purchasing a home and you should have them put to the side prior to applying. If a lender sees that you have enough money set aside to pay for all of your closing costs, they may be more likely to approve your loan.

Most people must obtain financing when purchasing a home. You can greatly reduce the stress of financing your home if you fully understand this process. This information will make the process easy for you.